LIMRA Reports 14% Rise in New Life Premium

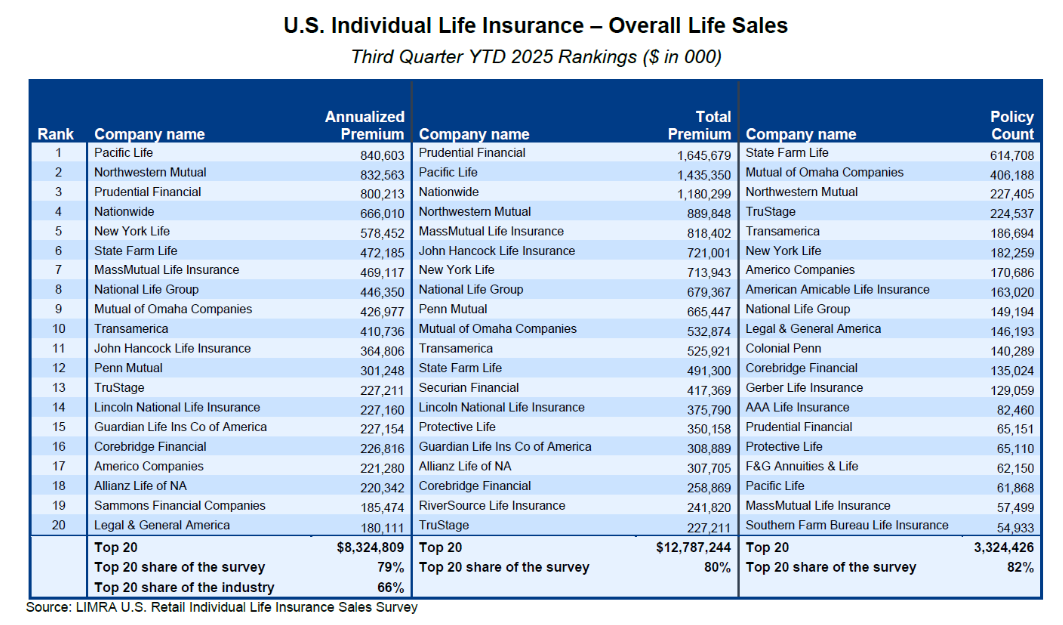

Pacific Life Insurance Co. took over the top spot in life insurance new annualized premium through the first three quarters, LIMRA announced Wednesday.

PacLife new annualized premium through three quarters rose nearly 33% from 2024 to $840.6 million. The insurer has been in a tight battle with Northwestern Mutual in recent quarters. Northwestern reported a 2.2% increase in year-to-date premium to $832.6 million.

Overall, new annualized premium increased 14% year over year to $4.3 billion in the third quarter, according to LIMRA’s individual life insurance sales results, which represent 80% of the U.S. market. The number of policies sold rose 10% in the third quarter.

In the first nine months of 2025, new annualized premium totaled $12.7 billion, up 12% over the prior year. Policy count rose 6% year-to-date.

“It was another strong quarter for individual life insurance sales with whole life products driving overall policy sales growth. Interestingly, final expense sales were the determining factor of whole life growth, propelled by middle- and lower-income consumer demand,” said Sean Grindall, senior vice president and head of Life and Annuities, LIMRA and LOMA. “Overall, 2025 has been an extraordinary year with total premium growth expected to be in double-digits. The last time we witnessed this level of growth was in 2021 during the pandemic. Strong demand for accumulation products, the expansion of the simplified products and a robust final expense market spurred this year’s performance.”