Indexed life and annuity products are the subject of many regulator meetings and class-action lawsuits. Despite that negative publicity, indexed life and annuity sales are booming. Wink, Inc. reported third-quarter annuity sales of $115.2 billion, up 6.6% compared to the previous quarter. All annuities include the multi-year guaranteed annuity, traditional fixed annuity, indexed annuity, structured annuity, variable annuity, immediate income and deferred income annuity product lines.

On the life insurance side, indexed products were a lone bright spot, Wink reported. All universal life sales for the third quarter were more than $1.1 billion, down 0.5% compared to the previous quarter. All universal life sales include fixed UL, indexed UL, and variable UL product sales.

The annuity story

Noteworthy highlights for all annuity sales in the third quarter include Athene USA ranking as the No. 1 carrier overall for annuity sales, with a market share of 8.1%. Massachusetts Mutual Life Companies came in second place, while Allianz Life, Corebridge Financial, and Jackson National Life rounded out the top five carriers in the market, respectively.

Total third-quarter sales for all deferred annuities were $110.9 billion, up 6% compared to the previous quarter and up 40% compared to the same period last year. All deferred annuities include the multi-year guaranteed annuity, traditional fixed, indexed annuity, structured annuity and variable annuity product lines.

Noteworthy highlights for all deferred annuity sales in the third quarter include Athene USA ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 8.4%. Massachusetts Mutual Life Companies continued in the second-ranked position, while Allianz Life, Corebridge Financial, and Equitable Financial completed the top five carriers in the market, respectively. Massachusetts Mutual Life’s Stable Voyage 3-Year, a MYG annuity, was the No. 1 selling deferred annuity, for all channels combined, in overall sales for the second consecutive quarter.

Total third quarter non-variable deferred annuity sales were $79.7 billion, up 8.2% compared to the previous quarter and up 45.5% compared to the same period last year. Non-variable deferred annuities include the MYG annuity, traditional fixed annuity, and indexed annuity product lines.

Total third-quarter variable deferred annuity sales were $31.2 billion, up 0.7% compared to the previous quarter and up 27.7% compared to the same period last year. Variable deferred annuities include structured annuity and variable annuity product lines.

Total third quarter income annuity sales were $4.3 billion, up 27.4% compared to the previous quarter. Income annuities include immediate income annuity (SPIA) and deferred income annuity product lines.

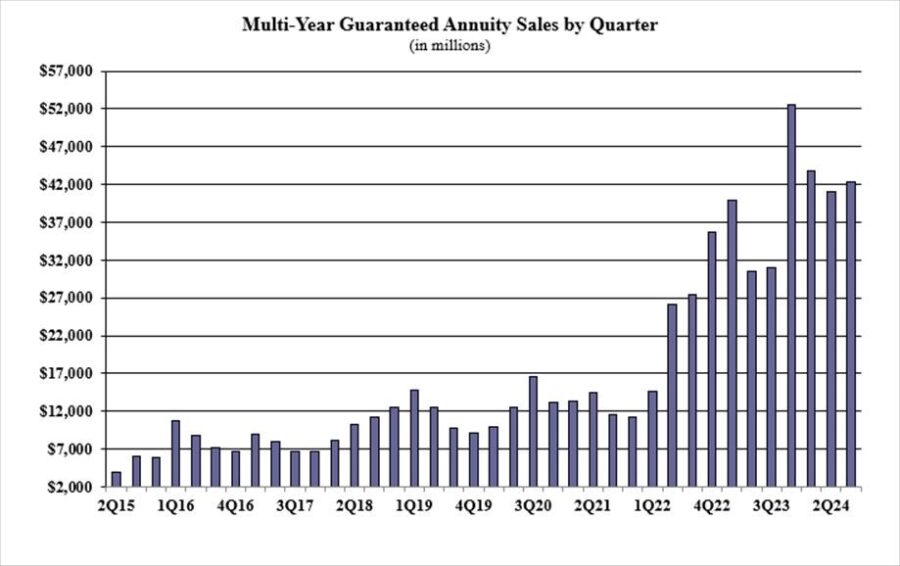

Multi-year guaranteed annuity sales in the third quarter were $42.4 billion, up 3.3% compared to the previous quarter, and up 36.9% compared to the same period, last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Traditional fixed annuity sales in the third quarter were $516.7 million, up 2% compared to the previous quarter, and up 4.2% compared to the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Indexed annuity sales for the third quarter were $36.8 billion; sales were up 14.6% compared to the previous quarter, and up 57.8% compared to the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500. This was a record-setting quarter for indexed annuity sales, topping the second-quarter 2024 record by 14.6%.

Sheryl Moore, CEO of both Wink, Inc., and Moore Market Intelligence, said, “It was another record-setting quarter for indexed annuity sales. Already YTD sales have nearly beat out the full year 2023’s results.”