As reported by Telos Actuarial in both Q1 and Q2 of 2024, Medicare supplement rate increases have been increasing relative to prior years. Now, results through the third quarter are in.

In general, Medicare claim trends have been elevated since 2023 and carriers have begun implementing larger rate actions to manage their loss ratios back toward the pricing targets.

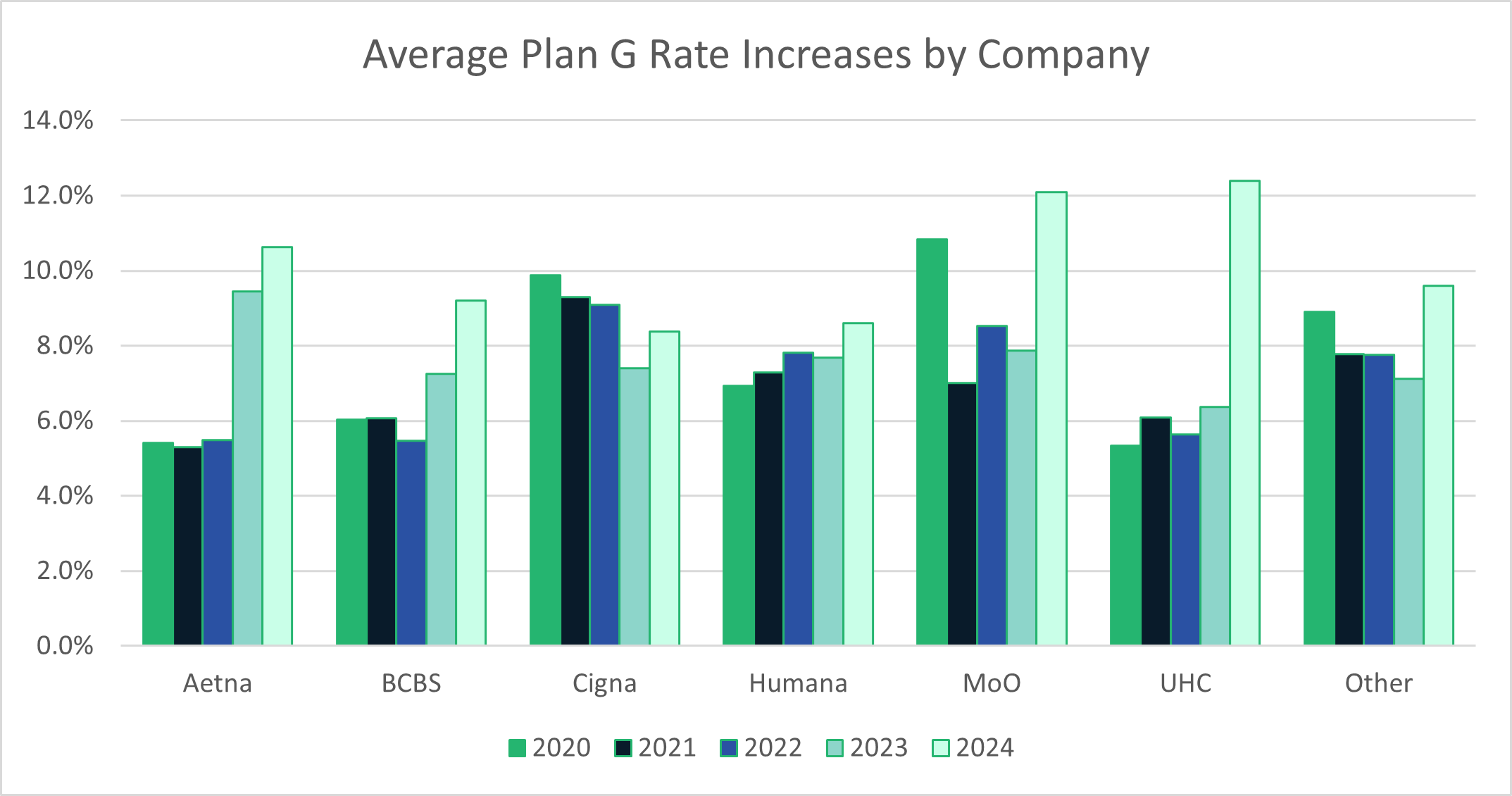

The charts below summarize the average historical rate increases of the most prominent carriers in the Medicare supplement space. This data pertains only to open blocks of business and does not consider instances where companies are implementing large rate decreases as they re-enter the market using old paper. All carriers besides the largest six have been grouped together as “Other”. The data for 2024 is year-to-date while all other years utilize a complete year of data.

Let’s start with Plan G.

Each group exhibits larger rate increases in 2024 than in 2023. The data suggests that Aetna, Mutual of Omaha and UHC have taken significant steps to address the increasing claims trend compared to prior years. Alternatively, Cigna and Humana rate increases are more aligned with what they have taken historically. It will be interesting to see if some of the higher historical averages will help prevent the need for double digit increases or simply delay them.

Next up is Plan N.

Here all groups, except for BCBS and Humana, display larger increases in 2024 than in 2023. Some companies show a more gradual reaction to increasing claims trend while others have acted more swiftly. The “Other” category shows that most companies are taking significantly elevated Plan N increases in 2024.

For all plans, the trend of higher rate actions are expected to continue throughout 2024 as claims come in higher than previous years and push up loss ratios.